Reverse payroll calculator

16 hours agoNational Insurance contributions had increased from 12 to 1325 in April after a 125 percentage point rise was introduced to pay for health and social care - this will be. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions.

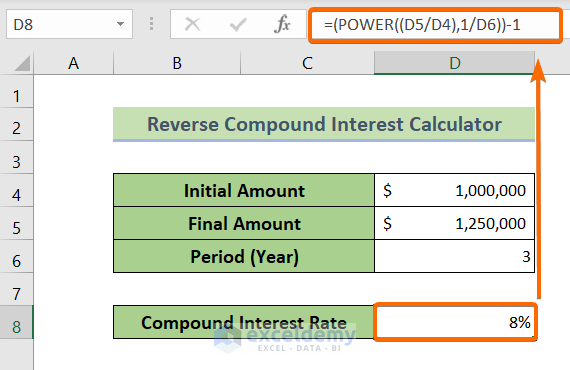

Reverse Compound Interest Calculator In Excel Download For Free

All other pay frequency inputs are assumed to be holidays and vacation.

. Our combination calculator will allow you to calculate the number of combinations in a set of size n. How to calculate annual income. The gross pay estimator will give you an estimate of your gross pay based on your net pay for a particular pay period.

Use this federal gross pay calculator to gross up wages based on net pay. Future height or width. A Reverse Sales Tax Calculator is useful if you itemize your deductions and claim overpaid local and out-of-state sales taxes on your taxes.

Get Started With ADP Payroll. Plug in the amount of money youd like to take home. In total 905000 micro small and medium.

The US Salary Calculator is updated for 202223. Need to start with an employees net after-tax pay and work your way back to gross pay. Take for example a salaried worker who earns an annual gross salary of 65000 for 40 hours a week and has worked 52 weeks during the year.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Reverse Tax Calculator 2022-2023. All Services Backed by Tax Guarantee.

17 hours agoNext year this will be worth 4200 on average for small businesses and 21700 for medium sized firms who pay National Insurance. It can be used for the. Below are your federal gross-up paycheck results.

Federal Gross-Up Calculator Results. This salary calculator assumes the hourly and daily salary inputs to be unadjusted values. The only thing to remember about claiming sales.

This calculator is for you. Paycheck Results is your gross pay and specific. Overtime pay per period.

The US Salary Calculator considers all deductions including Marital Status Marginal Tax rate and percentages income tax. C B PAPR. Then enter your current payroll information and.

Learn More About Our Payroll Options. Ad Process Payroll Faster Easier With ADP Payroll. For example if an employee earns 1500.

First enter the net paycheck you require. YEAR 2022 2021 2020 Net Salary Per Select one. Process payroll in 2 minutes or.

65000 - Taxes - Surtax. Easy Online Run payroll from work home or the office. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Or Select a state. This calculator helps you determine the gross paycheck needed to provide a required net amount. Get Started With ADP Payroll.

Tax Management Automatically calculates files and pays federal state and local payroll taxes. Simplify Your Employee Reimbursement Processes. Enter up to six different hourly rates to estimate after-tax wages for hourly employees.

The results are broken up into three sections. The algorithm behind this overtime calculator is based on these formulas. B A OVWK.

For example if an employee receives 500 in take-home pay this calculator can be used to. Ad Process Payroll Faster Easier With ADP Payroll. Talk To A Professional Today.

Overtime pay per year. The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. Computes federal and state tax withholding for.

This calculator helps you determine the gross paycheck needed to provide a required net amount. A pay period can be weekly fortnightly or monthly. Plug in the amount of money youd like to take home each pay period and this calculator will tell you what your before-tax earnings need to be.

Discover ADP Payroll Benefits Insurance Time Talent HR More. This calculator will evaluate a postfix expression. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

Then enter your current payroll information and. It will confirm the deductions you include on your. First enter the net paycheck you require.

It uniquely allows you to specify any combination of inputs. This valuable tool has been updated for with latest figures and rules for working out taxes. Ad See How MT Payroll Services Can Help Your Business.

A RHPR OVTM.

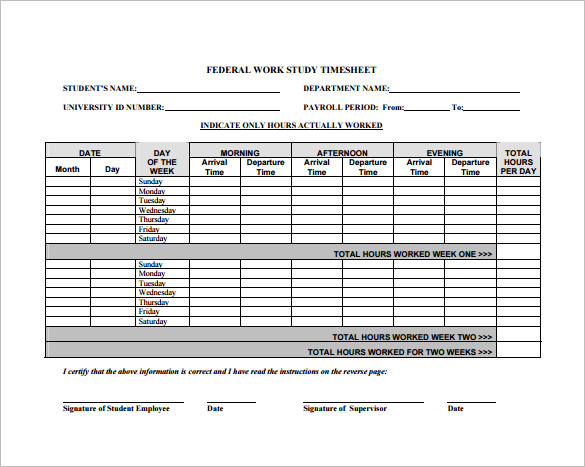

8 Hourly Paycheck Calculator Doc Excel Pdf Free Premium Templates

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

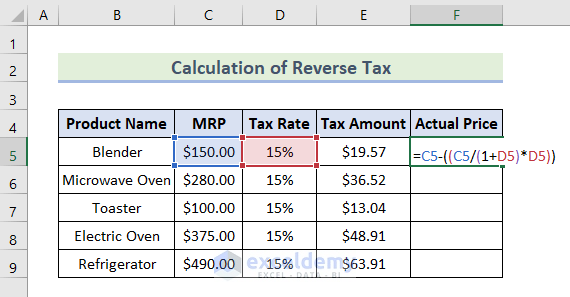

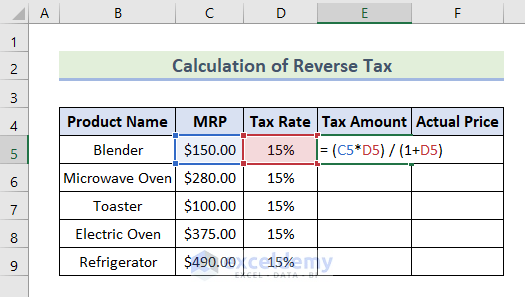

Reverse Tax Calculation Formula In Excel Apply With Easy Steps

Reverse Tax Calculation Formula In Excel Apply With Easy Steps

Payroll Calculator With Pay Stubs For Excel

Reverse Percentages Calculator Online

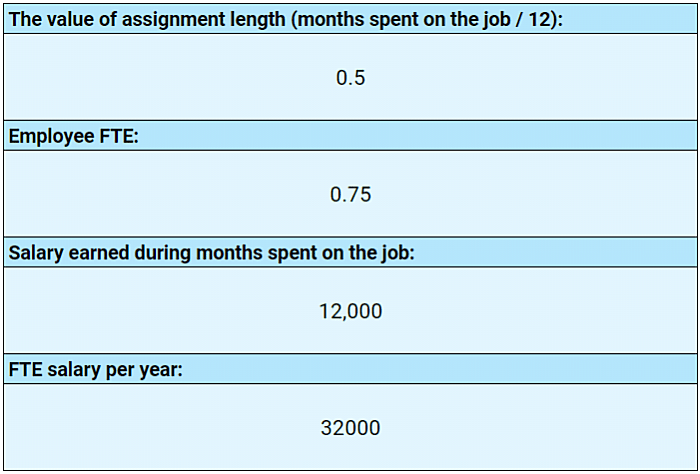

What Is Full Time Equivalent And How To Calculate It Free Fte Calculators Clockify Blog

Payroll Calculator With Pay Stubs For Excel

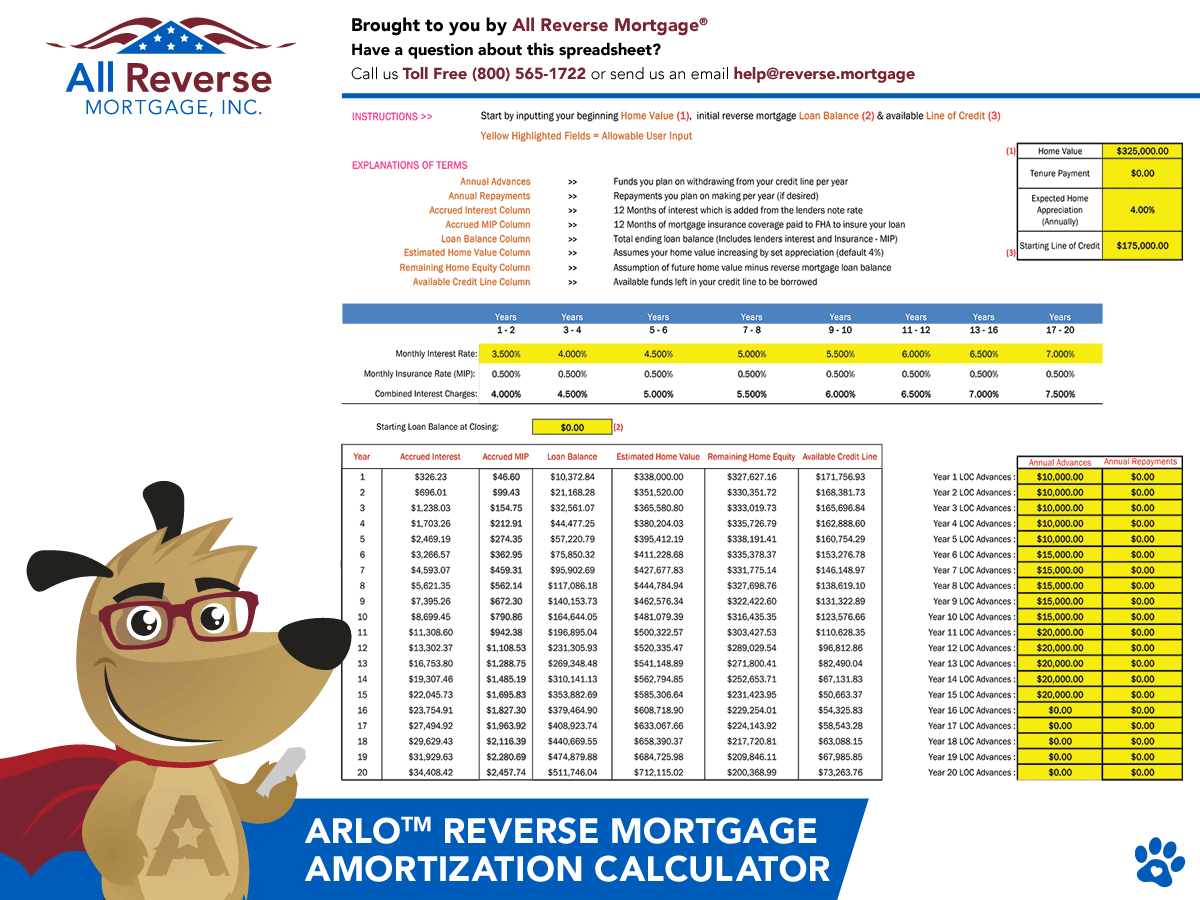

Free Reverse Mortgage Amortization Calculator Excel File

Reverse Sales Tax Calculator

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Reverse Sales Tax Calculator 100 Free Calculators Io

Net To Gross Calculator

Free Online Payroll Calculator Online Payroll Calculator Employee Payroll Calculator

Payroll Calculator With Pay Stubs For Excel

Reverse Mortgage Calculator Reverse Mortgage Pay Off Mortgage Early Mortgage Calculator

Top 3 Reverse Mortgage Calculators In 2022 No Personal Info